Reskill and Upskill Plan

Reskill and Upskill Plan

Guest writer Ron Wilson brings a blog post on lifelong learning this week with “Reskill and Upskill Plan.”

I came across a book titled “Long Life Learning” written by Michelle Weise. The title intrigued me due to my interest in and commitment to Lifelong Learning. The need for skills changes along the way and this book does an excellent job of sharing the why’s and how’s of the challenge.

Here are a few quotes from the book that will help set the importance of the rest of the article.

- Workers who are fifty-five and older are staying in the workforce well into their 60s and 70s.

- Many of the baby boomers will experience at least twelve job changes by the time they retire.

- The number of job transitions will only increase with time, as people confront longer and more turbulent work lives.

- Education has largely been thought of as a “one and done” experience.

- Technology’s transformation of nearly every facet of our economy means that we will all need to develop new skills and knowledge at a pace and scale never seen before.

- The future of work changes the future of learning.

Developing a Personal Reskill and Upskill Plan

The bullet points above, and many other examples in the book, identifies the importance and provides direction in developing a personal reskill and upskill plan that will be critical in success of our business, and our employees.

Developing a personal reskill and upskill plan is crucial in today’s rapidly evolving professional landscape. Here are several key reasons why it is important:

- Adaptability to Technological Changes

- Technological Advancement: We have all experienced the challenges of implementing a new business system and updated technology within an organization. Industries are experiencing rapid technological advancements, requiring continuous learning to stay relevant. Automation, AI, and digital transformation are changing job requirements. In a previous blog I shared the expansion of the “Tool Belt Generation” job titles and career paths that are providing many new opportunities to the employees of today. New roles, new skills, and upgrading old skills.

- Job Market Evolution: Roles that exist today might be obsolete tomorrow, while new roles will emerge. Reskilling and upskilling ensure individuals can transition smoothly into a new job function. Reskilling and upskilling will play a significant role in addressing the labor shortage issues.

- Career Growth and Opportunities

- Enhanced Employability: Employers value employees who are proactive about their learning. A well-rounded skill set makes individuals more attractive to current and potential employers.

- Promotion and Salary Increase: Upskilling can lead to higher responsibilities, promotions, and better compensation. Demonstrating a commitment to ongoing learning can also increase an employee’s chances of career advancement.

- Personal Development and Job Satisfaction

- Increased Confidence: Gaining new skills boosts confidence and empowers individuals to take on new challenges.

- Job Satisfaction: Engaging in continuous learning can lead to greater job satisfaction as employees feel more competent and capable in their roles.

- Economic Stability

- Job Security: Continuous learning helps in maintaining job security in an unpredictable economic climate. Employees with a broad skill set are more likely to retain their jobs during layoffs.

- Financial Resilience: With a diverse skill set, individuals can explore freelance opportunities or transition between industries more easily, contributing to financial stability.

- Innovation and Creativity

- Encouraging Innovation: Learning new skills can spark creativity and innovation. Employees who bring fresh perspectives and innovative ideas are invaluable to organizations.

- Problem-Solving: A diverse skill set enhances problem-solving abilities, enabling employees to approach challenges from various angles.

- Lifelong Learning Culture

- Adaptation Mindset: Developing a habit of continuous learning fosters a growth mindset. This mindset is essential for personal and professional development.

- Setting an Example: Individuals who prioritize their own learning can inspire colleagues and peers, contributing to a culture of continuous improvement within the organization.

- Navigating Career Transitions

- Career Shifts: Whether by choice or necessity, reskilling and upskilling provide the tools needed for successful career transitions. This is particularly important for those switching industries or roles.

- Futureproofing: Proactively acquiring new skills can future-proof a career, preparing individuals for unforeseen changes in their professional paths.

Developing an Effective Plan.

Now that we have listed several reasons why Reskill and Upskill plans are important, let’s look at what a personal reskill and upskill plan may consist of:

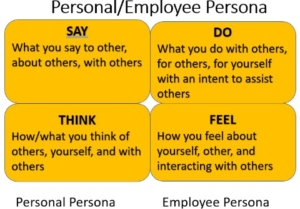

- Assess Current Skills: Identify strengths and areas for improvement. Regularly assess the current skills of employees to identify gaps and areas for development.

- Offer Diverse Learning Options: Provide a variety of learning formats such as workshops, online courses, mentorship programs, and on-the-job training.

- Set Clear Goals: Align Training with Business Goals: Ensure that reskilling and upskilling initiatives are aligned with the strategic goals of the organization. Define what you want to achieve, and the skills required to reach those goals.

- Research Trends: Stay informed about industry trends and emerging skills. Look outside the dealership in other industries and how similar roles have changed.

- Create a Learning Path: Choose courses, workshops, or certifications that align with your goals.

- Allocate Time: Dedicate specific time for learning and practice regularly.

- Seek Feedback: Engage with mentors or peers for constructive feedback.

- Monitor Progress: Regularly review your progress and adjust your plan as needed. Track and Measure Progress: Monitor the effectiveness of training programs and adjust as needed to ensure the evolving needs of the organization and its employees are being met and accomplished.

- Encourage Lifelong Learning: Foster an environment where continuous learning is valued and encouraged.

- Provide Support and Resources: Offer the necessary resources, including time, funding, and access to learning platforms, to support employees’ development.

This all sounds complicated and time consuming, but start here:

- A few roles across the organization and expand systematically.

- Review the current job descriptions and the changes required to meet the needs of the future.

- Identify avenues of training. This may be accomplished in-house, with local community colleges, professional dealer training organizations (such Learning without Scares), and professional certification programs. Most likely it will be a combination of the available resources.

- Define a training path that includes length of training time, length of executing/practicing the new skills, assess the success of the training.

- Celebrate along the way.